“But we’re insured, aren’t we?” How climate change is changing the rules of the game

by Martin Schachtschneider, BELFOR

Heavy rainfall and flash floods, drought and wildfires – what was considered rare extreme weather just a few years ago is now a regular part of Europe’s weather reality. Climate change is hitting businesses hard, directly, and with increasing frequency.

Traditional insurance policies are no longer enough

For risk managers, the question is no longer if their company will be affected, but when and where and how well prepared they are. One thing is certain: a traditional insurance policy alone is no longer sufficient to cope with the complex damage and business interruptions caused by natural disasters. Those responsible must think ahead and take action before damage occurs.

Natural disasters: Why business continuity must be rethought

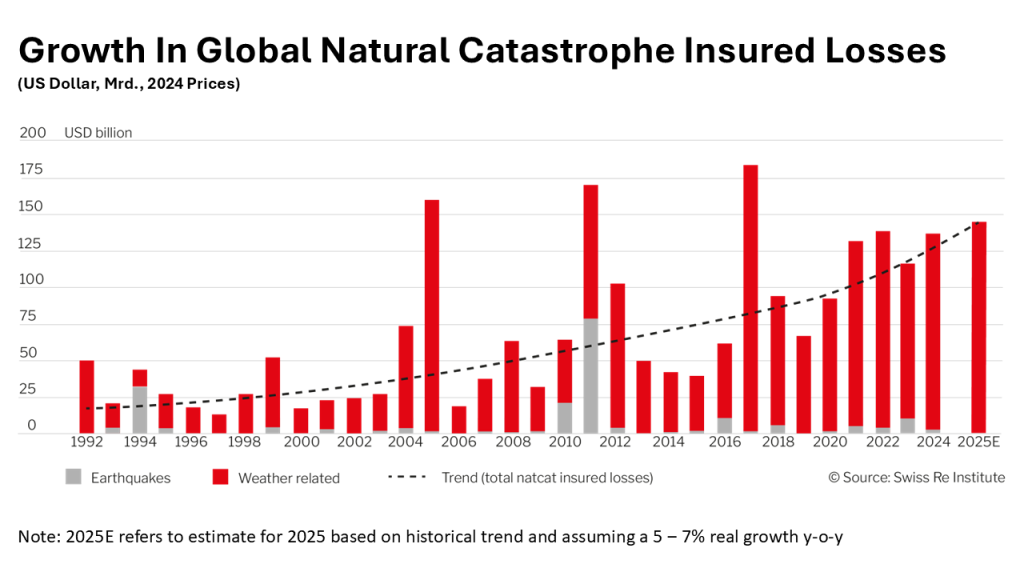

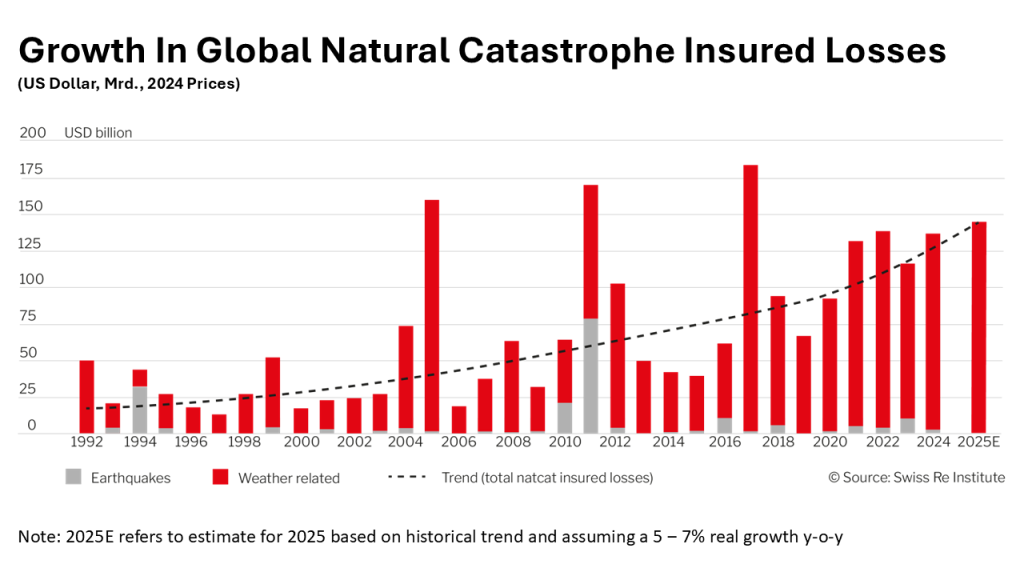

Figures from the latest Sigma report by Swiss Re paint a sobering picture: in 2024, natural disasters caused insured damages worldwide totaling 137 billion US dollars. And that’s just the tip of the iceberg.

Following a steady trend of annual growth of 5 to 7 percent, a further increase to around 145 billion US dollars is expected in 2025. Even more concerning is the long-term forecast: with a probability of 1 in 10, insured damages could exceed 300 billion US dollars this year. At the same time, the gap between insured and uninsured damages continues to widen.

Source: Swiss Re Institute, 2025

Such sums show that natural disasters are not only occurring more frequently but are also reaching a new economic dimension. For business continuity strategies, this means anyone still working with the assumptions of the past has a problem.

A look into the crystal ball: Where will it hit next?

Insurers work with complex models and probabilities. We, as the world’s largest disaster recovery company, see it firsthand. Since the COVID-19 pandemic, there has been no real pause: in 2021 the Ahr Valley, in 2022 Hurricane Ian, in 2023 heavy rainfall in Northern Italy, Slovenia, Spain, and Greece. And in 2024, an unprecedented series of floods in Poland, Dubai, Southern Germany, Switzerland, Austria, and Valencia continued the trend.

2024 was an exceptional year for BELFOR: never in our more than 50-year history have we had to deploy so many colleagues to other countries on such short notice within just a few weeks. Although we deal with extreme situations daily, this year has shown us just how fragile systems have become – and how quickly even large structures can reach their limits. One example: Valencia.

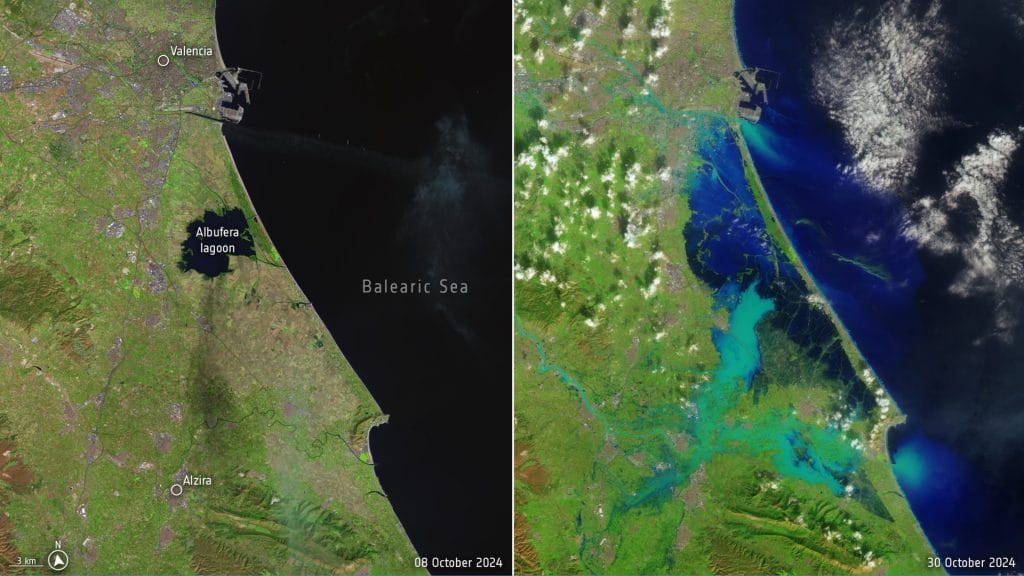

The Valencia case: When systems collapse

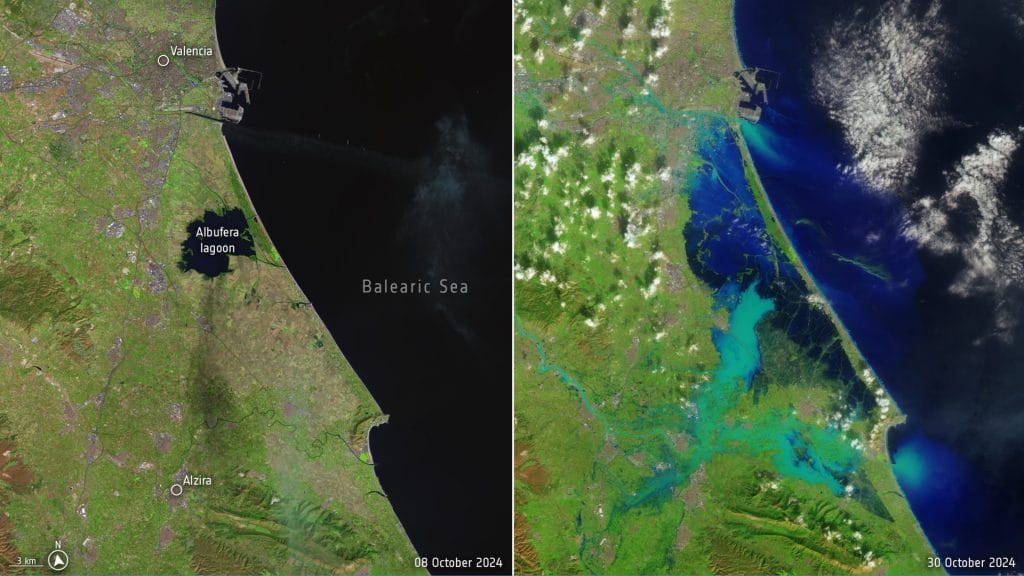

At the end of October 2024, the region around Valencia was hit particularly hard. In the city itself, there was little rain. But in the nearby mountains, massive rainfall unleashed a powerful flood wave. Within a few hours, water and mud devastated an area of more than 150 square kilometers – roughly the size of the Principality of Liechtenstein. More than 200 people lost their lives. Thousands lost their homes, and thousands of businesses were buried in mud.

Valencia and surrounding area: Left, before the flood. Right, immediately after the flood. Source: EPA

Our colleagues on site, even the most experienced among them, reported conditions they had never encountered before. The state-run “Consorcio,” (Consorcio de Compensación de Seguros) responsible for claims settlement in the event of natural disasters in Spain, was overwhelmed by a flood of damage reports. Within a very short time, the claims processing infrastructure collapsed under the pressure.

The few available loss adjusters were completely overburdened by the sheer number of cases. While additional personnel were mobilized from all over Spain, the volume of cases was simply too much to handle. The system collapsed at a critical point.

Disorientation as an additional risk factor

For the affected companies, the material damage was only part of the problem. Far worse was the fact that they had no foundation for action. What should we do? How high are the costs? When will production resume? These crucial questions went unanswered.

While mud solidified in factory halls, machines rusted, and mold spread across production lines, thousands of companies waited in vain for the loss adjusters and for the Consorcio approvals for recovery measures, which never came.

The resulting sense of helplessness led not only to financial losses, but also to frustration and uncertainty, a dangerous combination when decisions must be made in an already crisis-stricken situation.

Downtime is expensive, loss of reputation is more expensive

For risk managers, production downtimes are nothing new. Every company can calculate what a day of operational interruption costs. But in a real crisis, it’s not just numbers that matter – it’s people and perceptions.

When a CEO personally sees how days of downtime turn into millions in losses, theoretical risk management quickly turns into existential pressure. And while internal teams scramble for solutions, competitors are spreading the word externally: The plant is down, delivery delays are looming. In such moments, reputational damage is almost unavoidable, but it can be mitigated. The key lies in becoming operational again quickly.

Those who can communicate a reliable date for the resumption of production send a signal of stability. Studies show between 30 and 50 percent of a company’s value depends on its reputation. If you want to protect that value, you must be prepared and think beyond just insurance. Because if your insurance pays but no one is there to clean up the mess and restore operations quickly, what good is the insurance?

Good preparation makes the difference

Valencia clearly demonstrated: companies that had addressed the issue of damage response early on fared significantly better during the crisis. They knew which measures to initiate, which partners to contact, and which processes to follow, even when nothing else was working and the Consortium’s decision was still pending. These companies acted while others were still waiting. And that made a decisive difference.

Europe’s labor shortage. A rising risk for resilience

Labor shortages are severely impacting Europe. In Germany, 84% of companies report being affected, while in France, Ireland, Portugal, and the UK, the figures range between 80% and 84%. Sectors like construction, healthcare, logistics, and technical trades are under particular strain.

This challenge goes beyond HR, it poses a serious risk to business continuity. After natural disasters, companies rely on skilled workers to quickly restore operations. Yet across Europe, these crucial workers are in short supply, with many considering leaving their industries altogether.

Risk managers must act now: secure emergency partners ahead of time, clarify internal decision-making processes, and leverage technologies like 3D damage scans to accelerate recovery. In the face of a continent-wide labor crunch, proactive preparation is the best defense.

These are precisely the professionals needed in a disaster: individuals willing to work immediately under the toughest conditions, entering contaminated areas in full protective gear, dismantling machinery, cleaning control cabinets, and restoring complex technical systems with limited resources.

While political efforts around flood protection, structural prevention, and facility relocations exist, these measures are often costly, time-consuming, and only partially effective. Too often, political momentum fades just months after a disaster. For companies, this means relying solely on government solutions is an inadequate strategy.

Insurance industry at the limit

The insurance industry is also feeling the strain. Premiums are rising, coverage is shrinking, and risk models are becoming more stringent. The debate around mandatory insurance is in full swing, while in Florida, the first insurers are already declaring bankruptcy. The idea that “the market will take care of it” increasingly sounds more like a survival slogan than a viable plan. Money is important – but in the face of climate change, protection and resilience cannot simply be bought.

Three simple levers for greater resilience

So what can risk managers do today? Three concrete actions can make all the difference:

- Secure resources, before damage occurs: Through framework agreements with restoration companies like BELFOR, you can reserve capacity in advance, which you can access exclusively in the event of an emergency. This precaution gives you room to act while others are still waiting for help.

- Define processes ahead of time: Make sure your company knows who is authorized to make decisions in a damage scenario, what the priorities are, and whether the restoration partner is already approved by procurement. This clarity saves valuable time.

- Create a digital twin of the damage: Thanks to 3D technology, the damage can be “brought to the loss adjuster.” Using specialized cameras, damage can be scanned within hours. The loss adjuster can assess it accurately from their desk – a massive advantage for claims processing and time savings.

Screenshot: Digital twin using the BELFOR 360° Damage Scan, a high-resolution scan for damage documentation. In the image on the right, the steel beam still clearly shows how high the water level was.

No reason for resignation but a call for rethinking

Given these developments, one might be tempted to believe the profession of risk management has little future. But the opposite is true. The role of risk and insurance managers will not only grow in importance over the coming years. It will become the central force driving the transformation toward resilience.

Insurance will remain. But it will function differently. And it won’t be enough on its own. Those who want to be prepared must act today. Not someday. Now. The opportunity lies with risk and insurance managers to redefine their roles.